The Apple Card Savings account was first made available to customers on April 17. It quickly became clear that iPhone owners were strongly interested in the product. Forbes reports that the new Apple-branded high-yield savings account received contributions totaling up to $990 million within the first four days after it was made available to customers.

According to Forbes, the publication had conversations with two unnamed insiders who were familiar with the performance of the Apple Savings account shortly after its launch. However, the total amount of deposits has yet to be officially confirmed by Apple or by Goldman Sachs, Apple’s partner in the Apple Card Savings venture. Neither of these companies has commented on the matter.

Owners of Apple Cards deposited a total of $400 million in just the first day, which may not be as surprising given the vast number of iPhone users that Apple has in the United States. By the conclusion of the week, there had been the opening of around 240,000 accounts.

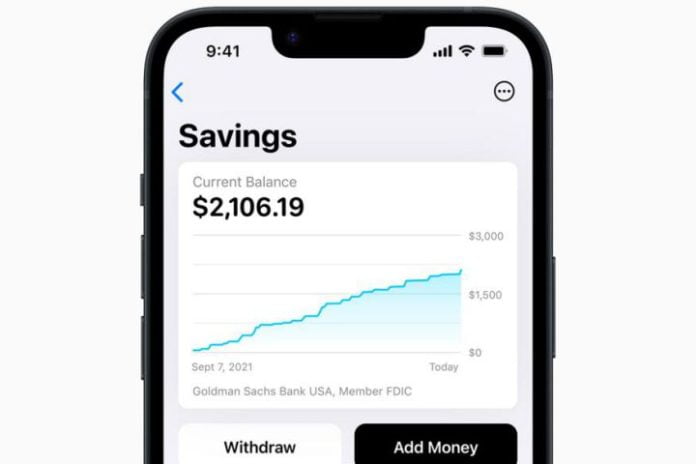

The Apple Savings account is only available to people with an Apple Card. It allows them to instantly deposit any Apple Cash earned using their Apple Card into the account. Apple Card owners can move additional funds from a checking account into a savings account associated with their Apple Card, where the money will accrue interest.

With the simplicity of creating a savings account, the annual percentage rate (APR) that Apple is now giving of 4.15% is very attractive. If you have an Apple Card, setting up an account is simple and takes only a few minutes; once it’s set up, you may use it just like any other savings account. There are no fees or minimum balance requirements, but the accounts can’t exceed the FDIC insurance limit of $250,000.

The Apple Savings account will be advantageous over other high-yield savings account providers thanks to its competitive annual percentage rate (APR) and easy-to-use interface. Dealing with a digital bank is often required to obtain a better rate for a savings account. Apple is one of only a handful of well-known financial companies that can compete with it on APR. Comparatively, the interest rate offered by Discover is 3.75%, while Citi Bank’s rate is 3.85%. The annual percentage rate (APR) American Express offers is 3.75%. In comparison, the APR offered by Capital One is 3.50%, and the APR offered by Barclays is 4%.

The Wallet app is used to manage the Apple Card and the Apple Savings account. Through a user interface that is both straightforward and comprehensive, one can monitor their earnings.